Gettin' SAASy

How one company’s product-to-service evolution is opening new markets and democratizing the banking sector

gettin-sassy

P&H Solutions Inc. (P&H) is the U.S. market leader in developing cash management and commercial banking software. Founded in 1983 and (therefore) initially dedicated to the development of DOS and Windows products, the company’s product offerings are now entirely web-based. P&H today has an installed base of over 100 financial institutions (FIs) in production, including icons such as J.P. Morgan and Merrill Lynch but also numerous credit unions and smaller regional banks. P&H software serves as the interface between these institutions and their customers, enabling the latter to perform assorted banking activities remotely.

As little as 5-6 years ago P&H sold 100% of its software on the ‘in-house,’ or ‘license model.’ Financial institutions ran their own hardware, bought Web Cash Manager ‘product modules,’ and paid P&H significant project management fees for the personnel and know-how required to configure the programs and machines involved and bring the new system to market (when FI customers would make live, money transactions using the system). Currently, however, the majority of the deals P&H closes adhere to an entirely different model.

One-half to a full two-thirds of P&H customers today are installed in the company’s ‘Outsource Solution Center’ (OSC) With this offering, P&H relieves financial institutions of the burden of hosting and administering their own hardware. FIs choose from among the same product modules as those offered under the license model but run them on machines that P&H manages in partnership with a third party, NCR. The difference between models is entirely transparent to the end-users (FI corporate customers).

P&H’s outsource model was made possible by a new technology (the internet), and by the observation from members of a formerly-excluded market segment (small FIs) that the technology could be leveraged to put them on an even playing field with the big guys. This paper details the circumstances leading to the outsource offering, the differences between the outsource and license models, and the process that P&H went through to set up its Outsource Solutions Center.

Background

Through most of the 1980s and 1990s P&H developed and sold DOS and Windows versions of its cash management software. Large FIs and their corporate customers installed the software, which enabled the latter to submit batch-based transaction instructions via modem. 1998 saw P&H’s release of Web Cash Manager (WCM) – a move consistent with a software-industry-wide trend towards web-based application delivery and its inherent economies. While installation of P&H software was still required on the FI-side, software distribution to FI customers was eliminated as these could now use the ubiquitous Internet Explorer or Netscape Navigator to interface with their financial institutions.

But almost as soon as the initial WCM release was marketed, P&H sales people and executives started sensing that the move to an internet-based product promised benefits far beyond those implied by just the saved postage and logistics of an eliminated client software distribution requirement. “Our DOS and Windows products were really only available to large institutions because of the significant, up-front capital outlays they required,” explains Terry Monteith, P&H Senior VP of Product and Marketing. “Initially this was true of Web Cash Manager under the license model as well. But around 1999, with WCM on the market for about a year, we started hearing from smaller banks that if we could run the software for them, they’d be able to afford same technologies as the big guys. So we gave it a shot.”

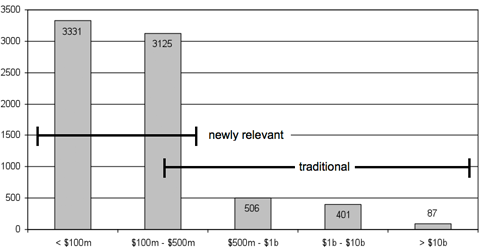

And the shot hit home. By assuming hardware and administration responsibilities and offering a revenue sharing-based pricing scheme (which in effect amounts to a rent), P&H lowered the up-front outlay required of banks by a factor of 10. This proved the key to opening up entirely new markets for P&H and the Web Cash Manager product, as illustrated by the figure below.

Figure 1 Number of U.S. commercial banks by total assets, with P&H’s traditional and newly relevant market segments highlighted. Data as of 9/30/2006, provided by FDIC.

The Two Models Compared From an FI’s Viewpoint

The table below summarizes the key FI considerations of price, payment schedule, and time-to-market for the licensed and outsourced deployment models. Figures are for the ‘Enterprise’ edition of Web Cash Manager with all modules installed and full functionality delivered.

[img 2]

Product, Services, and Rents

When P&H switched its focus from DOS and Windows to the internet, it did so because of the evident benefits that web-based software promised in terms of customer-base growth (as P&H is a B2B company, the growth was to be in its clients’ customer bases but the value of this growth was of course to be shared). Product delivery, however, continued in much the same way as during the era of the company’s modem-reliant products. And indeed many of P&H’s clients still adhere to this ‘license’ model, whereby the Web Cash Manager product is bought outright and physically installed on machines at the client sites. The value of the product is bought and transferred.

[img 3]

Figure 2 The traditional value transfer model. FI buys Web Cash Manager outright from P&H (assuming its value), rents required consulting and support services, and sells access to the product it now owns to its corporate customers.

In contrast to the value transfer model above, P&H has, for close to a decade now, been developing its OSC offering. As described, this is a model in which P&H does not sell the Web Cash Manager product itself, but instead sells access to it. As the number of FIs renting this access has increased and the outsource operation has grown, P&H has found that it in turn has needed to purchase services from other, third-party providers. In effect, the values of the separate services accrue as we move downstream along the chain.

Figure 3 The outsourced value accrual model. PH rents hosting (from NCR) and data redundancy (from Savvis) services; FIs rent Web Cash Manager modules and system management from PH; Corporate customers rent access form FIs to the Web Cash Manager functionality that lets them manage their treasury operations.

Transformation Process

Almost as soon as Web Cash Manager was released, P&H started hearing requests for an outsource operation from smaller banks who had too long been shut out of the big-technology market. In response, P&H effectively called the segment’s bluff by having its sales force proactively explore the idea during 1-on-1 sales calls to potential clients. The company needed a pioneer. “We felt from a gut level that there was an opportunity there for us,” Monteith explains. “We just wanted to get one bank to commit so that we’d have a concrete reason to invest.”

Stage 1 – Pioneering

In 1998/9 they got their trailblazer. During what Monteith calls ‘Stage 1’ of the Outsourcing venture, P&H ran the WCM software for this initial client, and those that tumbled in on its heels, on machines housed at the company’s headquarters in Newton, MA, just outside of Boston. Existing company resources were redistributed to support the effort.

It didn’t take long for the company to recognize what it had spawned. “Within the first year it became pretty clear to us that this was going to take off,” Monteith says. “We had 15-20 banks installed in our outsourcing center and it became clear that we, in turn, were going to have to outsource parts of the operation.”

FIs opting for P&H’s new Outsourcing Solution Center were choosing to entrust the non-core areas of IT infrastructure and software administration to what was in effect a second party – the company whose software was necessitating the infrastructure and administration. As a software development firm, P&H had fairly robust internal IT resources and expertise that were able to absorb the infrastructure requirements of its early Outsourcing Solution Center adopters. But with 20 banks installed and more knocking at the door, those resources were stretched and company management realized that it, in turn, needed to divest itself of pieces of the operation not tied to its core software development and support mission.

P&H tapped NCR Corporation, with whom it had an existing reseller agreement, for the job of hosting the machines and infrastructure that would run Web Cash Manager installations for OSC clients. With the agreement, physical hardware supporting the operation moved to Maryland, U.S., while at P&H headquarters in Massachusetts a barebones team was kept on to remotely manage the installations.

Figure 4 Alignment of actors and core competencies (in black) over time. Initially FIs assume 3 main operational areas, only one of which is their core business. With the NCR deal, the 3 main operational areas have been distributed to the three corresponding specialists.

Stage 2 – Growing Up

P&H had succeeded in finding a capable partner to assume the hardware implications of the Outsource Solution Center. But the customers kept coming, and even having escaped infrastructure responsibilities, those involved with the outsourcing project found themselves kicking hard to keep their heads above water. “At 25 to 30 installed banks, we started feeling some pain,” says Monteith. “It’s bootstrapped, fly-by the seat of your pants stuff and we were having a hard time keeping up. We basically addressed this through staffing, and through bringing in outside expertise”

P&H was no longer treating the Outsource Solution Center as an experiment or side project, but rather as a profit center of huge potential to which dedicated resources needed to be devoted. And as the company became more adept at managing the environment with more success stories to share, the profiles of the banks who were signing up diversified. Quoted in 2001, Mike Thongpaithoon, who was then P&H’s director of client services, described P&H’s outsourcing customers. “They are typically regional and smaller community banks that need to compete with the big boys. But we also have some big customers – banks in the billion-dollar plus range – outsourcing because they just don’t want to deal with the hassles."

Over the next years, as the number of installed banks climbed towards 60, more big banks would come, each presumably bolstered in confidence by the one that preceded. The signing of a $10b FI into the Outsourcing Solution Center was a milestone until recently, when a $70b bank chose to outsource to P&H. “The stakes are definitely getting pretty high, “ says Monteith. “And organizationally, we’re starting to look at Outsourcing as one of our biggest customers.”

Stage 3 – Maturing With the Environment

As P&H has matured in its management and delivery of outsourced solutions, so too has the regulatory environment in which it operates. Today, the challenges P&H faces with the Outsource Solution Center derive from both the size of its customer base and a set of government rules that has grown up around the internet banking industry. A partial list of these includes:

- Management of WCM patch and upgrade installations

- Management of multiple ‘pods’ or ‘environments’ for customers in different time zones

- Government-mandated SAS Level I and II security audits

- Sarbanes Oxley compliance

- Disaster recovery and failover capability (in essence, backup solutions)

- Government-mandated user sign-on authentication

“We’re basically now responsible for anything regulatory happening in the environment,” says Monteith. Financial institutions, in other words, outsource not just the day-to-day operational aspects of an enterprise-level software implementation, but also all associated compliance concerns. As a result, P&H has brought in top gun management for the Outsource Solution Center from the outside and developed new competencies in knowledge areas it considers specific to the core service it provides with the operation. It continues, however, to pen deals with other providers for services and third-party products it views as ancillary. Recently, for example, P&H brought on a second hardware hosting company, Savvis, which has assumed disaster recovery and failover duties for the outsourcing operation – basically running mirrored installations of the NCR machines in Maryland.

Outcome and Future Directions

By any measure, the P&H Outsource Solution Center has proven a resounding success. Talking to Monteith, and indeed anyone who has been involved in the effort, about the experience of getting the operation off the ground elicits from them terms and phrases such as ‘frenetic,’ ‘rapid growth,’ ‘hanging on by the seat of our pants.’ At every step along the way, growth in the installed customer base has met or exceeded internal predictions.

During the near-decade that P&H has been running its Outsource operations it has acquired market knowledge and Professional Services expertise that the company now leverages by offering consulting services to large financial institutions. And in a bid to appeal to even the smallest banks and budgets, the P&H marketing group is now exploring the idea of what it calls ‘processor options.’ With this option, banks could, in effect, choose to share installations of WCM with other institutions that were willing to forego customization for price. A cookie cutter version of the software at an even lower price point.

Figure 5 Schematic (NOT to scale) depicting relative sizes of three P&H segments and market share in each. Grey bar represents number of institutions in each segment; black bar portrays P&H’s penetration of the segment. Dollar signs indicate the comparative revenue represented by a typical deal closed in each segment.

For all P&H’s success, however, the amazing thing in this B2B environment is that after 23 years in business and depending on who you talk to, P&H’s total installed customer base (including outsourced and in-house installations) is between 100 and 150 financial institutions – approximately 2% (using the more optimistic figure) of the seven-to-eight thousand banks detailed in Figure 1, on page 2. Should P&H decide to market ‘processor options,’ the decision will have been made, in effect, in order to blanket all segments with offerings. It certainly won’t have been made because the company has exhausted the markets it currently finds itself in. The choice P&H currently faces with its Outsourcing Solution Center is one between breadth and concentration.

Takeaways

The Following dicta are based on four aspects that proved key to P&H’s successful growth of its Outsource Solution Center, and which should be considered in any B2B product-based to service-based marketing evolution.

- Dip your toe in first… preferably with a partner When P&H first started hearing murmurs about how an outsource offering could potentially provide the keys to a hitherto locked market, dollar signs must have flashed in more than a few sets of eyes. To the marketing group’s credit, however, the company didn’t lurch forward with an if-you-build-it-they-will-come effort. Instead, it courted a partner with whom to test the waters. P&H got guaranteed revenue for its efforts and the trailblazing client enjoyed special treatment. Had the venture proved a flop, P&H’s losses would have minimal. But it didn’t, and we know the rest.

- Buy Services to Provide Services One of the most intriguing aspects of P&H’s mature Outsource Solutions Center is the string of service-provider agreements it comprises (see Figure 3, page 2). The value chain is in fact a service chain. As P&H’s outsourcing operation grew, the company found itself having to devote an increasing proportion of energy and expertise to extending its core competencies of WCM development and administration. Less and less bandwidth was available to absorb management of the supporting infrastructure, which in itself was becoming more intricate with the expanding operation, and so the company contracted with third-parties who specialized in hardware and failover. In short, P&H found that by outsourcing parts of its outsourcing operation, it was able to concentrate on maximizing the differentiating value for its customers.

- Balance Eight years into the Outsourcing venture, Monteith says that finding the right equilibrium is crucial to success. “The challenge becomes how to keep functionally competitive, be on top of the all regulatory requirements, offer quality implementation services, and deliver this at a good price point. It’s really a big balancing act.” On top of freeing P&H to concentrate on its core competencies, the third-party deals referenced above let P&H deploy the required hardware at a cost significantly lower than would have been possible otherwise. P&H has spent approximately \$5m on hardware, pays NCR and Savvis their rents, and employs twenty people to run the Outsource Solution Center. With 60 outsourcing contracts worth between \$2m and \$5m each, the model has proven profitable. Nonetheless, should the balance Monteith describes be disturbed – should the technologists, for example, succeed with an internal sell of the latest internet technology for the WCM product without determining if its value would be perceived and bought by P&H’s customers – the profits which are now healthy could well prove to be ephemeral.

- Book the Recurring Revenue If P&H’s outsourcing operations had proven just a means to open new markets, celebration would have been justified on this count alone. In fact, however, the very pricing model that suddenly made small banks a viable segment for the company also proved a boon to the company’s planning capabilities. The deals P&H signs for in-house installations bring the company immediate revenue in today’s dollars. But the revenue sharing model inherent in the Outsource Solution Center deals brings something just as valuable – a predictable, recurring revenue stream, or an annuity. Knowing the proportion of a future year’s revenue goals that has already booked allows the company to develop coherent, long-range plans for growth.